The Financial Conduct Authority (FCA) says it has found no evidence showing banks have shut or denied accounts to customers based primarily on their political beliefs.

The Financial Conduct Authority (FCA) says it has found no evidence showing banks have shut or denied accounts to customers based primarily on their political beliefs, according to a preliminary review launched in the wake of the Nigel Farage debanking row.

The information supplied by banks, building societies and payment companies suggests that no firm closed an account between July 2022 and June 2023 primarily because of a customer’s political views, the regulator said. It also added that by far the most common reasons providers gave for closing, suspending or declining an account was because it was inactive/dormant or because there were concerns about financial crime.

The FCA also said that further work was needed for it to be sure that no one had their bank account closed due to their political views.

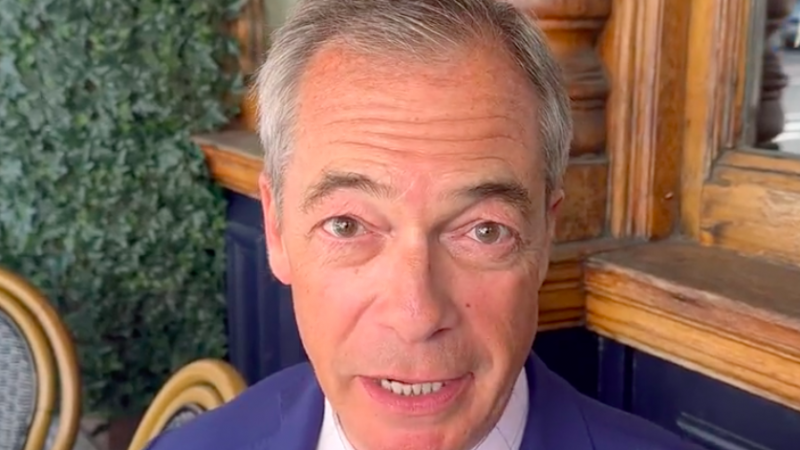

The regulator’s preliminary review came after claims from former UKIP leader Nigel Farage that his account with private bank Coutts was shut because it disagreed with his political views.

Farage obtained a document looking at his suitability as a Coutts customer, which included minutes from a meeting in November last year reviewing his account.

It confirmed that Mr Farage had fallen below their publicly available commercial criteria to be a customer. However, documents obtained by Farage from Coutts also suggested the closure of his accounts was taken partly because his views did not align with its “values”, including his position on LGBTQ+ rights and friendship with former US president Donald Trump.

While the review was launched in response to Farage’s battle with Coutts, it is understood that the data does not cover his case, given that the bank never followed through with the closure. Farage said in July that Coutts’s new boss had offered to retain his account.

Nikhil Rathi, FCA Chief Executive, commented: “While no bank, building society or payment firm reported to us that they had closed accounts primarily due to someone’s political views, further work is needed for us to be sure.

“As we undertake that work, the time is also right for a debate on how we balance access to bank accounts with the threat of financial crime, as well as firms’ reasonable risk and commercial appetites. An important question for policy makers is whether all individuals, businesses and organisations should have the right to an account, as is the case in some other countries.

“What’s more, international comparisons suggest robust digital identities could play an important role not only in countering financial crime but also in aiding financial inclusion.”

Basit Mahmood is editor of Left Foot Forward

Left Foot Forward doesn't have the backing of big business or billionaires. We rely on the kind and generous support of ordinary people like you.

You can support hard-hitting journalism that holds the right to account, provides a forum for debate among progressives, and covers the stories the rest of the media ignore. Donate today.