Potential options for taxing wealth – based on Spain’s model – could raise significant funds for the public purse.

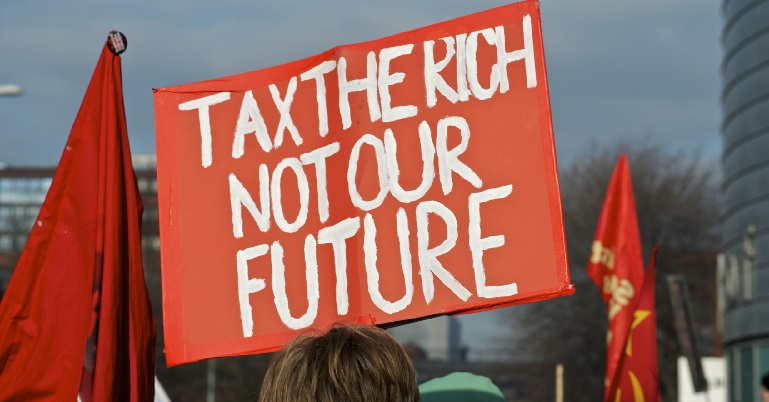

A new poll has revealed there is widespread support for ensuring the richest in society pay more in taxes in Britain. The survey was commissioned by the Trade Union Congress (TUC), ahead of its annual Congress, which starts in Liverpool this weekend.

The research found that over six in 10 people are calling for the wealthy to pay higher taxes, including over half (53 percent) of Tory voters in 2019. Three in four are also in favour of capital gains to be taxed at either the same rate or higher than income tax. This included 73 percent of Tory 2019 voters. Only 4% of the public think wealthy people should pay less tax, the survey found.

Paul Nowak, general secretary of the TUC, said it is time to “end the grotesque inequality of the Tories,” and that a national conversation about wealth tax needs to be had. The union body added that the Tories have allowed the wealthiest in Britain to “feather their nests” while working people have suffered the worst pay crisis for two centuries.

In the wake of the polling, the TUC described Britain has having a “broken economic model” which “rewards wealth, not work.”

With “living standards plummeting, public services on their knees, and rampant wealth inequality blighting every corner of the country”, the union body says fair taxation must be a key part of a wider set of policies to help “reset the economy to work for working people.”

The poll also found there is cross-party public support for windfall taxes on excess profits. 75 percent of the public support a windfall tax on banks’ excess profits – including 76% of Conservative 2019 voters

4 in 5 people support a windfall tax on energy companies’ profits, while 7 in 10 support a windfall tax on large online retailers’ excess profits, like Amazon.

The research follows analysis by the TUC which found that a modest wealth tax on the richest 140,000 individuals, equating to just 0.3 percent of the population, could yield £10.4bn for the public purse.

A similar model of taxing the small number of individuals with wealth over £3 million, £5 million and £10 million, excluding pensions, exists in Spain.

Known as a ‘solidarity tax on large fortunes,’ the Spanish government taxes very wealthy individuals with the purpose of generating more revenue from taxpayers with greater economic capacity to help the government tackle the energy and inflationary crisis.

The solidarity tax applies for 2022 and 2023 and only to Spanish tax residents with worldwide net wealth above €3 million, and non-tax residents with net Spanish assets above €3 million.

Spain’s model is to be reviewed next year to decide about its application in future years.

Gabrielle Pickard-Whitehead is a contributing editor to Left Foot Forward

Left Foot Forward doesn't have the backing of big business or billionaires. We rely on the kind and generous support of ordinary people like you.

You can support hard-hitting journalism that holds the right to account, provides a forum for debate among progressives, and covers the stories the rest of the media ignore. Donate today.