The outgoing PM has totally failed to bolster Britain's toothless tax avoidance regulations.

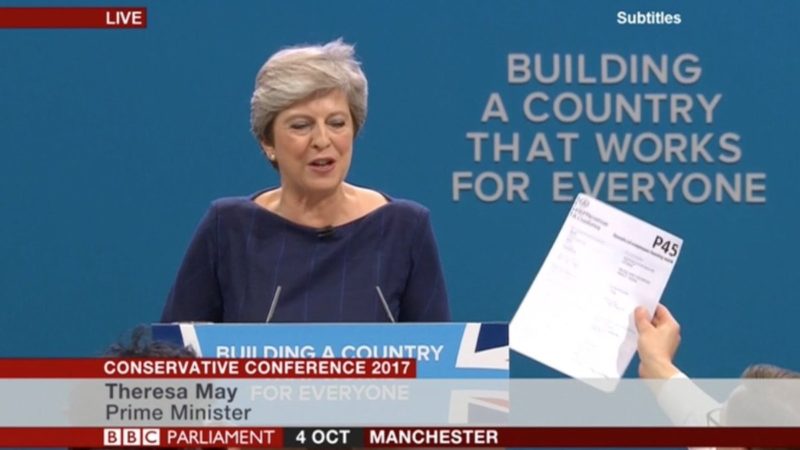

As Theresa May gets ready to leave office and join the gravy train of political lectures, consultancies and directorships, the word is that she wants to leave a legacy of reform. That won’t happen in relation to tax avoidance.

The government has failed to shackle the tax avoidance industry. This week Tax Justice Network reported that the UK is among a handful of OECD countries and jurisdictions most responsible for the breakdown of the global corporate tax system.

British Overseas Territories and Crown Dependencies, as well as the UK-based accountants, lawyers and financial experts are leading players in the global tax avoidance industry. The alchemy of these enablers of tax avoidance enables corporations to avoid around $500bn a year in taxes and prevents governments around the world from making vital investment in social infrastructure.

The UK has been particularly soft on the enablers of tax avoidance. Despite numerous court cases concluding that big accountancy firms peddled unlawful tax avoidance schemes, no firm has been investigated, fined or prosecuted. In the case of Her Majesty’s Revenue and Customs v Pendragon plc and others [2015], the UK Supreme Court said that “the KPMG scheme was an abuse of law.” Yet there were still no consequences for the firm.

The government claims to be going after the enablers. “An enabler” is defined by Clause 65 and Schedule16 of the Finance (No. 2) Act 2017 as any person who is responsible, to any extent, for the design, marketing or otherwise facilitating another person to enter into abusive tax arrangements. The legislation holds out the possibility that enablers may face a fine equivalent to their fees, not tax which may have been lost because of their predatory practices.

The legislation only deals with practices which are deemed to be “abusive”. Fines can’t be levied until the resource-strapped HMRC has managed to win a court case.

Whether tax arrangements are “abusive” will depend on the tests provided by the General Anti-Abuse Rule (GAAR) introduced in 2013. Under this, something is abusive if after having regard to all the circumstances, the entering into or carrying out of the arrangements cannot reasonably be regarded as a reasonable course of action, in relation to the relevant tax legislation. Many tax avoidance practices already established are unlikely to be regarded as abusive.

Before taking legal action against ‘abusive’ arrangements, the taxman is required to seek the opinion of the GAAR Panel. This Panel is populated by individuals connected with law and accountancy firms – including the very firms criticised by the courts for peddling unlawful avoidance schemes. In the past, a member of the GAAR Panel was caught on camera offering tax avoidance tips.

The GAAR Panel has given around a dozen opinions. None of these seem to relate to any big corporations or clients of law and accountancy firms supplying members of the Panel.

For a considerable time, giant multinational corporations such as Google, Microsoft, Starbucks, Amazon, Apple and others have used intragroup interest payments, royalties, loans, management fees and other practices to shift profits to low/no tax jurisdictions.

For example, the former controllers of Thames Water loaded the company with intra-group debt through entities in the Cayman Islands and elsewhere. Profits were moved overseas, and UK corporate taxes were avoided. (It is estimated that 40% increase in real household water bills since privatisation is mainly due to continuously growing interest payments on debt rather than investment and other costs.)

Private equity has used intragroup transactions to shift profits and extracted cash from companies such as Bernard Matthews, Maplin and Caffe Nero.

Consider the example of BHS. Its board of directors under the control of Sir Philip Green sold a number of properties to Jersey-based Carmen Properties, and then leased them back. His wife, Tina Green was the ultimate beneficial owner of both companies.

The rent paid by BHS became a tax deductible expense in the UK, and Jersey did not levy any corporation tax on profits made outside the Island. Carmen passed profits to beneficial owner Tina Green – resident in Monaco, which does not levy income tax. [Ed: The family denies the arrangement is for tax reasons, and there is no suggestion of illegality].

None of the above practices will be affected by the supposed crack down on tax avoidance or its enablers.

The House of Lords Economic Affairs Committee warned that:

“The GAAR is so narrow it will not apply to current issues of public concern about the international tax planning techniques relating to tax paid by multinational companies which limit the amount paid in the UK…

“There is a misconception that GAAR will mean the likes of Starbucks and Amazon will be slapped with massive tax bills. This is wrong and the Government needs to explain that to the public. GAAR is narrowly defined and will only impact on the most abusive of tax avoidance.”

Theresa May’s lasting legacy? Indulging big business and the tax avoidance industry.

Prem Sikka is a Professor of Accounting at University of Sheffield, and Emeritus Professor of Accounting at University of Essex. He is a Contributing Editor for Left Foot Forward and tweets here.

2 Responses to “Prem Sikka: Theresa May’s legacy on tax avoidance is unforgivable”

nhsgp

13,000 bn pounds of state debt.

450,000 per tax payer.

30% of taxes going on debts.

220 bn a year going on the debts.

Pensioner poverty

Austerity

Lack of investment

all caused by accounting fraud and socialist debts hidden off the books

Patrick Newman

No wonder the Tories have not done much on money laundering and tax evasion – tax avoidance is evasion simply where the government have not written tax rules properly! We also have a Chancellor in complete denial of widespread poverty.