While criticising Corbyn, Sugar seemed oblivious to marginal tax rates

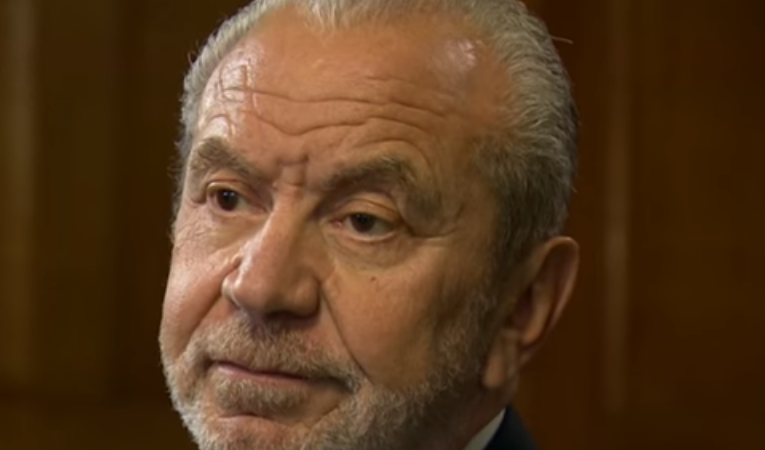

The Apprentice host Alan Sugar has been mocked on social media after unwittingly revealing he does not understand how the UK’s income tax system works.

Sugar tweeted that “a person who earns over £100k under @jeremycorbyn might end up with just 30K i.e. 70% tax”.

Sugar was then criticised for appearing to misunderstand marginal tax rates and for exaggerating the level of tax Labour is likely to implement on high earners.

Currently, people pay no tax on the first £12,500 they earn. They then pay 20% on everything they earn between that and £50,000.

On earnings between £50,000 and £150,000, they are taxed at 40% and, on everything above that, a 45% tax rate is applied.

So someone earning £100,000 a year would pay income tax of 27% on their total earnings. Sugar appeared to believe they would currently pay 45%, as that is the highest tax rate they reach.

In its last manifesto, Labour pledged to make the 45% tax rate apply to earnings above £80,000 instead of the current £150,000. It also promised to introduce a tax rate of 50% on earnings above £123,000.

This is lower than the highest rate of income tax for most of Margaret Thatcher’s rule, which was 61%.

In response to criticism, Sugar ignored the claim that he doesn’t understand the income tax system and doubled down, claiming that this 70% tax was implemented by Francois Hollande in France.

Francois Hollande implemented a 75% tax on earnings above €1m (£780,000). So those paying £100,000 would not have been subject to this tax rate and, even if they had, it would not have applied to all their earnings.

Alan Sugar is a former Labour Party donor but left the party in 2015 in protest against the party’s perceived leftward shift.

He has since campaigned against the Labour Party and in favour of Theresa May and has promised to leave the country if Jeremy Corbyn becomes prime minister.

In recent years, his tweets have frequently been controverisal. In March 2018, he posted a photo of Adolf Hitler sitting next to Jeremy Corbyn.

In June 2018, he was accused of racism after tweeting a photo of the Senegal football team implying that they were the same people selling sunglasses on the beach in Marbella. After initially defending the tweet, he eventually apologised.

Joe Lo is a freelance journalist and a reporter for Left Foot Forward.

Left Foot Forward doesn't have the backing of big business or billionaires. We rely on the kind and generous support of ordinary people like you.

You can support hard-hitting journalism that holds the right to account, provides a forum for debate among progressives, and covers the stories the rest of the media ignore. Donate today.

9 Responses to “Alan Sugar reveals he doesn’t understand how income tax works”

Patrick Newman

Thomas, thanks for your contribution – perhaps you should have written the article. There is more about NI which as you say takes hold well ( £8500 pa) before the basic rate threshold of £12,500 about which the government make much publicity. NI is a tax on the very poorest and a reform is long overdue. VAT is a regressive tax and one of the few taxes the Tories have actually increased. Another is Council Tax (indirectly) which on balance is regressive (i.e. there is some correlation between property values and ability to pay) However look at this – Hartlepool – band d – £1392, Westminster – £754!

Jonathan Bagley

Whie we are in the EU, the standard vat rate of 20% cannot be lowered below 15% and the 5% vat rate on electricity and gas cannot be lowered.

Dave Roberts

Patrick Newman.

Basic economics will tell you that if there is a constant supply of labour in a particular sector in a particular sector then that will either hold or depress wage rates. Construction industry rates have hardly changed in the last ten years. It’s an industry I work in. Eastern Europeans have helped the construction private sector to boom and have held down the rates. No discussion, no argument.

Prem Sikka: Billionaires are a threat to democracy | Left Foot Forward

[…] millionaire Lord Alan Sugar has also threatened to leave the UK if the next Labour government levies higher taxes on the […]