A key BHS figure is finally being prosecuted - but the whole system needs reform to prevent another BHS-style scandal, argues financial expert Prem Sikka.

The Pensions Regulator has finally decided to prosecute a key figure in the scandal for failure to provide information sought by the regulator.

But sixteen months after its closure the BHS – one of the UK’s biggest retailers – there is little sign of any major reforms though the pensions regulator has just woken from its slumber.

Dominic Chappell (the figure being prosecuted) and his business vehicle Retail Acquisitions Limited had bought BHS for £1 from Sir Philip Green and his family in March 2015.

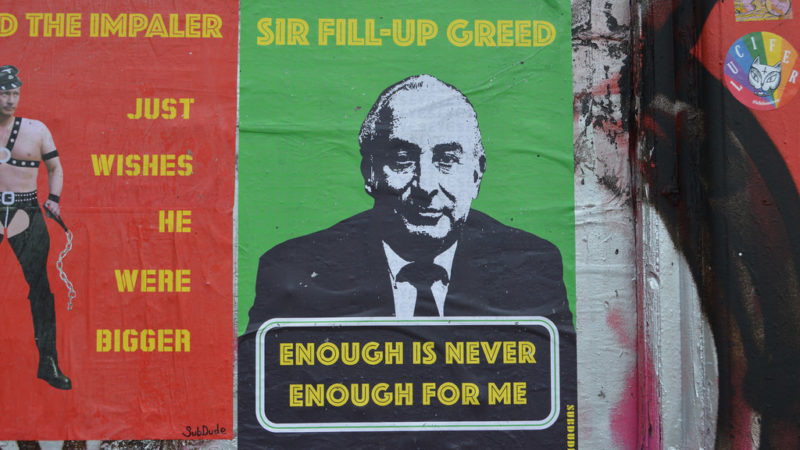

At that time, BHS accounts reported a deficit of £345m on the employee pension scheme. Sir Philip Green and his family had purchased BHS in May 2000 and extracted large amount of cash from the business in the form of dividends and a variety of transactions between the company and the Green family.

Administrators were appointed for BHS on 25 April 2016, followed by a liquidator on 2 December 2016. Around 20,000 past and present employees were left with a pension scheme deficit of £571m – which could have forced them to accept up to 77% reductions in their pension rights.

In early May 2016, the House of Commons Work and Pensions Committee and the Business, Innovation and Skills (BIS) Committee began a joint inquiry into BHS. A June 2017 report by The Pensions Regulator concluded that the main purpose of the sale of BHS by the Green family was to “postpone BHS’ insolvency to prevent a liability to the schemes falling due” – i.e. to avoid the pension liability. I

Then, in February 2017, the regulator persuaded Sir Philip to cough up £363m. No prosecution followed. Why not?

BHS is a sorry indictment of corporate governance in the UK. Virtually everything failed: executive directors, non-executive directors, auditors, advisors, lawyers and bankers, just to name a few.

Yet the UK still does not have an enforcer of company law, and there has been no urgency from the government to change anything. In its usual lackadaisical way, the Financial Reporting Council (FRC), the accounting regulator, is investigating only the 2014 audit of BHS.

Too many BHS type of scandals have been buried, and more will follow unless there are fundamental reforms.

Firstly, we need workers on the boards of all large companies.

If workers had been present in substantial numbers on the board of BHS and its parent company, it is extremely unlikely that they would have accepted the continuous deficit on the pension scheme.

Financial journalists and regulators are often seduced by the presence of non-executive directors on company boards. The non-execs are often friends of directors and rarely challenge the board.

BHS’s parent company had two non-executive directors. One was Sir Philip’s step-son and the other (the chairman) was his long-time friend and legal adviser.

Toothless tigers need to be replaced by elected worker directors.

Companies should be made to treat employees as stakeholders. Section 172 of the Companies Act 2006 requires directors to promote the success of the company for the benefit of its “members” i.e. shareholders, though they must have a nodding regard for the interests of the employees.

This does not give employees an equal footing with shareholders and offers no protection. Company law needs to be revised to redefine the purpose of a corporation and its obligations to stakeholders.

Here are five other changes which must be made:

- The directors of companies with deficits on their pension scheme should not receive pay rises unless they have reached a binding deficit reduction agreement with The Pensions Regulator.

- Directors cynically dumping pension scheme liabilities should be made personally liable for the debts.

- The payment of dividends or share buybacks by companies with pension scheme deficits should be conditional on them submitting a deficit reduction plan to The Pensions Regulator.

- All mergers, sale and takeovers of businesses with pension scheme deficits should be approved by The Pensions Regulator.

- In the event of insolvency, the pension scheme deficit should rank as a priority debt i.e. it should be paid from the proceeds of the assets before any other creditor is paid.

Another major reform needed is this: stop conflicts of interests, auditors should be banned from selling any consultancy service to their audit clients.

Between 2009 and 2014, PricewaterhouseCoopers collected £2.282m in audit fees and £9.04m in consultancy fees from BHS and its parent company. It advised on tax, pensions and other matters.

But the provision of consultancy increases their dependency on getting fees from a company – creating conflict of interests if that service is coming from auditors tasked with giving them a clean bill of health or not.

BHS and its parent company had been technically insolvent for many years – but no ‘red flags’ were raised by the auditors. Their files should be available to stakeholders so that everyone can see the extent of diligence, questions, time and audit effort by auditors.

Finally, the UK must have an independent and robust enforcer of company law.

All this has the potential to obstruct the occurrence of another BHS-type scandal. Ad while the Conservative government has shown little appetite for change, let’s hope the next Labour government will introduce these long-overdue reforms.

Prem Sikka is Emeritus Professor of Accounting at the University of Essex. He was an adviser to the Work and Pensions Committee for its investigation into BHS and related matters

Left Foot Forward doesn't have the backing of big business or billionaires. We rely on the kind and generous support of ordinary people like you.

You can support hard-hitting journalism that holds the right to account, provides a forum for debate among progressives, and covers the stories the rest of the media ignore. Donate today.

2 Responses to “Here’s how to prevent another BHS-style crisis”

Will

It brings back really horrible memories of when that crud of a man, Robert Maxwell sold his employees down the river by spending their pension money for them. It is very difficult to understand how obnoxious some people can be to others while most people are fair minded and not greedy. The laws will never change as long as we are governed by greedy, self-serving liars who feel supreme and immune.

patrick newman

Sensible proposals. A pension deficit can be measured in at least three different ways and only one of those involves where pension payments (and pension management costs) exceed investment income which is rare.

I also think that there should be the possibility for senior executives who commit serious offences of jail sentences. If a person who looted a box of mineral water in 2011 can be sent to jail so too should an executive who brought down the largest bank in the world (RBS) in 2008.

In all these matters of corporate management responsibility the principle of presumed diligence should be adopted – i.e no more excuses such as Murdoch jnr failing to read a complete email would be accepted by a court.