It's the latest in a string of policy reversals.

The government has reversed a policy that would have seen millions of key workers taxed for receiving coronavirus tests from their employers.

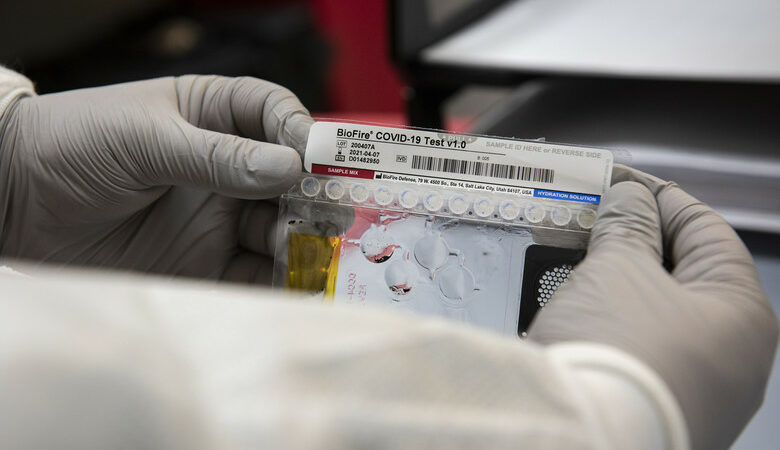

HMRC guidance published on 6h July stated that employees would face a ‘taxable benefit in kind’ when their employer pays for coronavirus testing.

This would have meant that employees would have had to pay income tax and National Insurance Contributions (NICs) on tests.

Mel Stride MP, Chair of the Treasury Committee, wrote to Rt Hon. Rishi Sunak MP, Chancellor of the Exchequer on Tuesday to look into this matter as soon as possible.

Left Foot Forward also raised it with the Prime Minister’s official spokesman at the lobby briefing for journalists on Tuesday.

The Chancellor responded to Mr Stride last night to say that the government has reversed this decision and will now introduce “a new income tax and NICs [National Insurance Contributions] exemption from income tax for employer-provided COVID19 antigen tests.”

Commenting, Mel Stride MP said:

“It would not have been right to increase the tax bill for workers every time that they had a coronavirus test. I’m glad that common sense has prevailed. And I’m grateful that the Chancellor has listened to the Treasury Committee and reversed this decision so swiftly.”

It’s the latest in a series of Tory u-turns, including providing free school meals during the holiday following an outcry led by footballer Marcus Rashford, extending proxy voting for vulnerable MPs during the pandemic, and ditching the Covid contact tracing app.

Josiah Mortimer is co-editor of Left Foot Forward.

Left Foot Forward doesn't have the backing of big business or billionaires. We rely on the kind and generous support of ordinary people like you.

You can support hard-hitting journalism that holds the right to account, provides a forum for debate among progressives, and covers the stories the rest of the media ignore. Donate today.