While criticising Corbyn, Sugar seemed oblivious to marginal tax rates

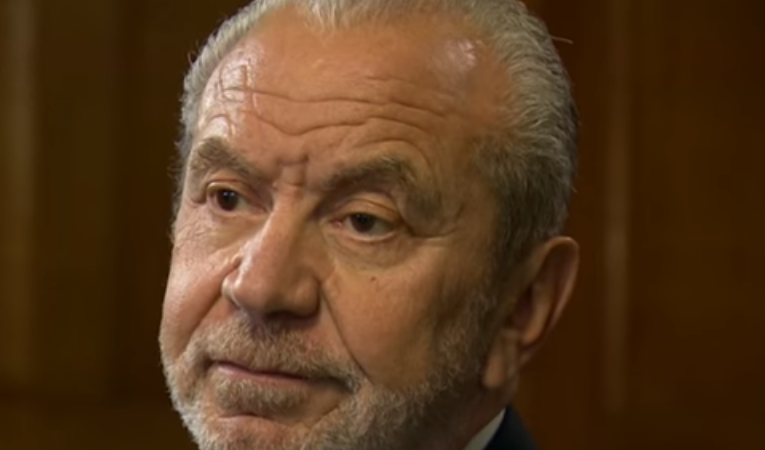

The Apprentice host Alan Sugar has been mocked on social media after unwittingly revealing he does not understand how the UK’s income tax system works.

Sugar tweeted that “a person who earns over £100k under @jeremycorbyn might end up with just 30K i.e. 70% tax”.

Sugar was then criticised for appearing to misunderstand marginal tax rates and for exaggerating the level of tax Labour is likely to implement on high earners.

Currently, people pay no tax on the first £12,500 they earn. They then pay 20% on everything they earn between that and £50,000.

On earnings between £50,000 and £150,000, they are taxed at 40% and, on everything above that, a 45% tax rate is applied.

So someone earning £100,000 a year would pay income tax of 27% on their total earnings. Sugar appeared to believe they would currently pay 45%, as that is the highest tax rate they reach.

In its last manifesto, Labour pledged to make the 45% tax rate apply to earnings above £80,000 instead of the current £150,000. It also promised to introduce a tax rate of 50% on earnings above £123,000.

This is lower than the highest rate of income tax for most of Margaret Thatcher’s rule, which was 61%.

In response to criticism, Sugar ignored the claim that he doesn’t understand the income tax system and doubled down, claiming that this 70% tax was implemented by Francois Hollande in France.

Francois Hollande implemented a 75% tax on earnings above €1m (£780,000). So those paying £100,000 would not have been subject to this tax rate and, even if they had, it would not have applied to all their earnings.

Alan Sugar is a former Labour Party donor but left the party in 2015 in protest against the party’s perceived leftward shift.

He has since campaigned against the Labour Party and in favour of Theresa May and has promised to leave the country if Jeremy Corbyn becomes prime minister.

In recent years, his tweets have frequently been controverisal. In March 2018, he posted a photo of Adolf Hitler sitting next to Jeremy Corbyn.

In June 2018, he was accused of racism after tweeting a photo of the Senegal football team implying that they were the same people selling sunglasses on the beach in Marbella. After initially defending the tweet, he eventually apologised.

Joe Lo is a freelance journalist and a reporter for Left Foot Forward.

Left Foot Forward doesn't have the backing of big business or billionaires. We rely on the kind and generous support of ordinary people like you.

You can support hard-hitting journalism that holds the right to account, provides a forum for debate among progressives, and covers the stories the rest of the media ignore. Donate today.

9 Responses to “Alan Sugar reveals he doesn’t understand how income tax works”

Mr Thomas Hall

Of course Alan Sugar is not as clever as he thinks he is, although sadly, the tax we pay is quite a bit more than the headline income tax figures.

National Insurance is the main one. 12% NI, and 13.8% Employer NI (which economically falls on wages), both of which kick in at around earnings of £8500 per year.

This means a basic rate taxpayer has a marginal rate of nearly 50%.

A salary of £20K gives a liability of £1.5K Income Tax correct, but also £1.3K NI and £1.6K Employers NI. So a take-home of £17.2K from a wage paid by the employer of £21.6K. This over £20%.

A salary of £50K get a take-home of £37.5K- paying £18K tax from £55.5K wage cost to employer. This is over 30%.

Then there are other taxes the low paid cannot really avoid: 20% VAT on many everyday goods, taxes on fuel (nearly 70%), sin taxes on beers/wines and other naughties. Council Tax (often in excess of £1500), Insurance premium tax, travel taxes- even the TV license.

The level of taxation on working people in this country is very very high- and in truth, this keeps them poor. Unable to save, unable to build wealth.

Ironically, we have very low taxes on land and property- so the rich stay in possession of the real wealth of the country, and the workers pay for the public services to keep it valuable.

nhsgp

You’ve ignored NI, both sorts. It’s a tax because it goes on the state’s debts.

Then there is council tax. That’s another chunk.

Then VAT

Then fuel duty

Then car taxes

then TV taxes

Then Insurance tax

Tax on beers

Tax in spirits.

….

And in return you get austerity

30% of taxes go on the debts.

nshgp

Two of the top land owners, the national trust and the RSPB.

How are we going to tax them?

Tom Sacold

It’s not tax that keeps working people poor. It’s the competition from low wage migrants.

Patrick Newman

Tom, presumably your post is an extract from your well researched, peer-reviewed academic paper!