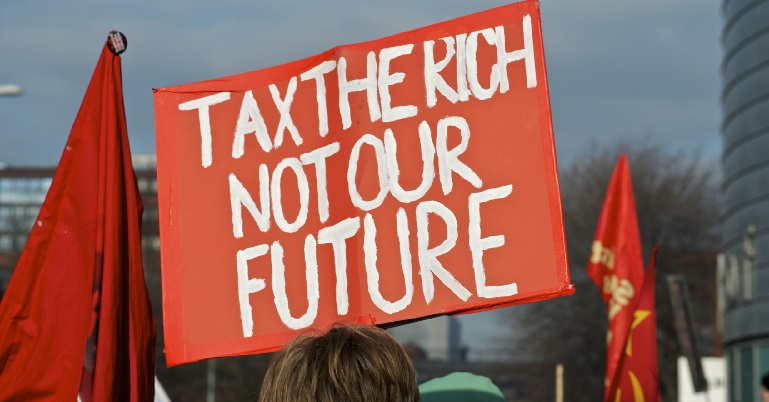

There are now a record 177 billionaires in the UK. A wealth tax is a necessary step for reducing inequalities and building a society that enables everyone to live a fulfilling life

The cost-of-living crisis is a crisis of poverty and inequalities and is inflicting hardship on millions of people. It is facilitated by the state though austerity, wage freezes, reductions in social security payments and erosion of welfare services.

For any progressive government, eradication of poverty and reductions in inequalities has to be a key priority. A wealth tax upon the richest is a necessary step towards that goal. This week, the UK House of Commons debated a motion calling for a wealth tax, tabled by Richard Burgon MP. It was supported by most of the speakers, but opposed by the government.

The public opinion is shifting. The Organisation for Economic Co-operation and Development (OECD), hardly a socialist organisation, has argued that “capital income taxes alone will most likely not be enough to address wealth inequality and suggests the need to complement capital income taxes with a form of wealth taxation”.

Civil society organisations, such as Oxfam, have urged the government to introduce wealth tax to “rein in extreme wealth and monopoly power”. It adds that “billionaires and corporations in the food, energy, pharmaceutical, and technology sectors are reaping huge rewards at the same time as the soaring cost of living is hurting so many”.

Some of the richest people are openly urging the government to reduce inequalities and social squalor by levying wealth tax. In an open letter to Chancellor Rishi Sunak, Patriotic Millionaires said “We know where you can find that money – tax wealth holders like us. We can afford to contribute more, and we want to invest in repairing and improving our shared services. We are proud to pay our taxes to reduce inequality, support stronger social care and the NHS, and to ensure that we’re building a more just and green society”. Yet, a government consisting of some of the richest people is not listening and content to abandon millions of people to misery, hardship and untimely death.

There is an overwhelming case for a wealth tax. Despite austerity and cost of living crisis, the wealthy have grown richer. The UK now has record high 177 billionaires with combined wealth is around £653bn, up more than £55bn (9.4%) since 2021. The richest 250 people are worth £710.723bn, compared to £658.089 billion in 2021, an 8% rise on last year.

The UK income distribution is highly skewed in favour of the wealthy. 42% of all disposable household income went to the top fifth, while only 7% went to the lowest-income fifth. Nearly 22 million adults (over 40% of adults) survive on annual income of less than £12,570, but pay VAT, fuel duties and council tax at the same rates as billionaires.

The tax system has exacerbated inequalities and poverty. The poorest 10% of households pay 47.6% of their income in direct and indirect taxes, compared to 33.5% by the richest 10% of the households.

In words of the OECD, “wealth accumulation operates in a self-reinforcing way and is likely to increase in the absence of taxation. High earners are able to save more, meaning that they are able to invest more and ultimately accumulate more wealth. Moreover, investment returns tend to increase with wealth, largely because wealthy taxpayers are in a better position to invest in riskier assets and generally have higher levels of financial education, expertise and access to professional investment advice”.

This inevitably leads to concentration of wealth in fewer hands. The wealthiest 10% of households have 43% of all the wealth in Great Britain; in comparison the bottom 50% who have only 9%. Almost a quarter of all household wealth in the UK is held by the richest 1% of the population. The richest 1% of households have total wealth was more than £3.6 million. The least wealthy 10% of households had wealth of £15,400 or less.

Inequalities exclude large sections of the population from economic and social consumption and lead to deeper recessions. The also reduce the effective tools available to governments to manage economic crisis. For example, to combat rising inflation governments hike interest rates, but that pushes the less well-off into even deeper poverty as they often rely upon debt to survive. In contrast, the wealthy are insensitive to interest rate hikes and can maintain their life style, and become even richer by higher interest rates and asset price inflation.

A wealth tax can take many forms. The Wealth Tax Commission recommended a wealth on individuals rather than households at the one-off rate of 5%, spread over a period of 5 years i.e. allowing a tax rate of 1% to be paid over each of the five years. With an asset threshold of £500,000, some £260bn could be raised for redistribution. If the threshold was raised to assets over £2m, some £80bn could be raised. Other formulations are also possible.

Poverty is the main cause of the cost-of-living crisis, social squalor and instability. Even the business folks know that they can’t flourish unless people have good purchasing power. A wealth tax is a necessary step for reducing inequalities and building a society that enables everyone to live a fulfilling life.

Prem Sikka is an Emeritus Professor of Accounting at the University of Essex and the University of Sheffield, a Labour member of the House of Lords, and Contributing Editor at Left Foot Forward.

Image credit: Plashing Vole – Creative Commons

Left Foot Forward doesn't have the backing of big business or billionaires. We rely on the kind and generous support of ordinary people like you.

You can support hard-hitting journalism that holds the right to account, provides a forum for debate among progressives, and covers the stories the rest of the media ignore. Donate today.