This week Shell reported that its profits have increased from $4.85bn to $19.3bn as rising energy prices have filled its coffers.

Prem Sikka is an Emeritus Professor of Accounting at the University of Essex and the University of Sheffield, a Labour member of the House of Lords, and Contributing Editor at Left Foot Forward.

Brits are facing a twin attack on their living standards. Price of energy is rising whilst disposable incomes are shrinking. Millions will dim lights, sit in cold rooms and face anxiety and mental health problems. This is a direct outcome of the visible hand of the institutions of government.

From 1st April, the price of energy for an average household will rise by £693 a year (54%) taking the annual bill from £1,277 to £1,971. This is about 25% of the average state pension and a large proportion of the income of the poorest. In October, another price increase is expected to double the current energy bills.

The government has offered help of £350, but it isn’t what it seems. £200 is touted as ‘discount’ to domestic electricity customers, but it isn’t. It is effectively a loan to households, repayable over the next five years. There is silence over the higher gas costs.

Council tax is expected to rise by about 5% this year, but to mitigate the energy price rise the government says there will be a £150 council tax rebate for most homes. This is of little benefit to people living in rented accommodation. Would the government compensate local councils for the loss of this revenue? There is little clarity.

Altogether, there is little help to people who have suffered years of austerity and wage freezes. Even if the government’s help of £350 is accepted at its face value; that still leaves households to find another £343 when they are facing higher food, transport and other bills. People’s capacity to absorb higher costs is further eroded by extra taxes. These include a 1.25 percentage point increase in national insurance and tax rises from the freezing of income tax thresholds and personal allowances.

The government has not cut VAT on domestic fuel, shifted green levies from consumers to general taxation, or levied windfall taxes on oil and gas companies. With retail price Index already running at 7.5%, it hasn’t increased the state pension which will rise by only 3.1% in April. Winter Fuel Payment of £100-£300 a year has remained unchanged since 2011. The minimum wage will rise by 6.6% in April, well below the anticipated rate of inflation. Last October, Universal Credit for 4 million families, often the poorest, was cut by £1,040 a year and there is no restoration or increment. Low and middle income households will be hardest hit by the energy price increase.

Other countries are also facing an energy price crisis. Their response is shaped by local politics and is different. For example, The French government has capped the energy price rise at 4%, reducing the profits of the state-controlled EDF and requiring it to sell cheaper nuclear energy to rivals. In contrast, the UK has privatised everything and the government has fewer economic levers to manage crisis.

Despite winning the nature’s lottery in the form of oil and gas in the North Sea, the UK does not produce all of its electricity. It relies upon imports and is more vulnerable to price volatility. Its gas storage facilities have been run down. The UK has around nine terawatt hours of stored gas reserves, compared to 168 in Italy, 151 in Germany and 117 in France. Without safety inventories, the UK is highly vulnerable to price shocks and supply uncertainties.

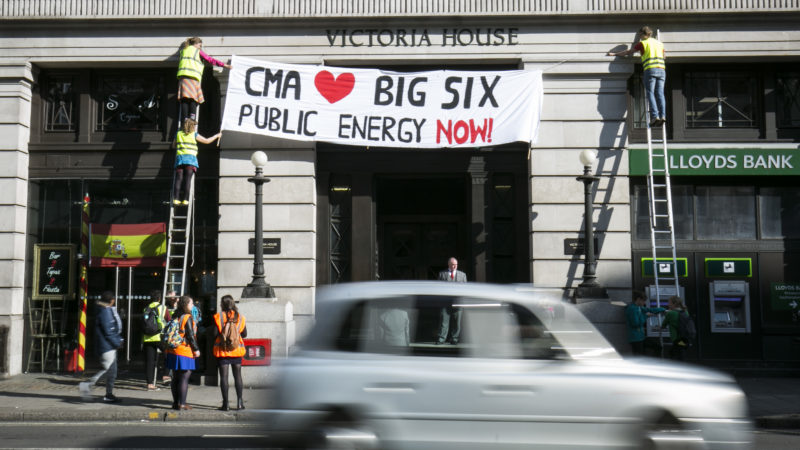

The UK’s privatised gas, oil and energy companies are poorly regulated. Profiteering is rife. This week Shell reported that its profits have increased from $4.85bn to $19.3bn as rising energy prices have filled its coffers. It is handing $8.5bn to shareholders through share buybacks. Since 2010, oil and gas companies have paid out £200bn in dividends . Shell and BP paid zero tax on North Sea gas and oil for three years to 2020. Oil/Gas companies get subsidies to decommission rigs. Big six energy companies have paid £23bn in dividends in the last decade. If these entities were in public ownership that would give government more policy options and people some respite from higher prices.

The UK government must levy windfall taxes to relieve pressure on households, but chooses not to. Others are more pragmatic. Oil/Gas companies operating within the Norwegian jurisdiction are subject to a general corporate tax of 22% and a special tax at the rate of 56% upwards i.e. there is form of permanent windfall tax. In 2019, Norway collected $21.35 tax for each barrel of North Sea oil whilst the UK collected only $1.72. Norway now has a sovereign fund of $1.4 trillion whilst the UK has squandered its oil/gas wealth and its public finances are a mess.

The energy price crisis isn’t just about markets. It is also about the UK obsession with privatisation, appeasement of corporations and poor regulation. Short-sighted government policies have neither generated sufficient revenues nor brought stability. Instead of a windfall tax and/or taxes on unearned income (such as capital gains) to cushion the effect of price rises, the government has again chosen to punish the less well-off which will create destitution and makes a mockery of its claims of levelling-up. The UK needs public-centred politics.

Left Foot Forward doesn't have the backing of big business or billionaires. We rely on the kind and generous support of ordinary people like you.

You can support hard-hitting journalism that holds the right to account, provides a forum for debate among progressives, and covers the stories the rest of the media ignore. Donate today.