A 'spiral of complacency' over consumer debt is posing a huge risk to the UK economy, the Bank of England has warned.

Leading figures are asking if the widening gap between consumer debt – up 10 per cent in the last year alone – and flatlining pay spells the start of the next financial crisis.

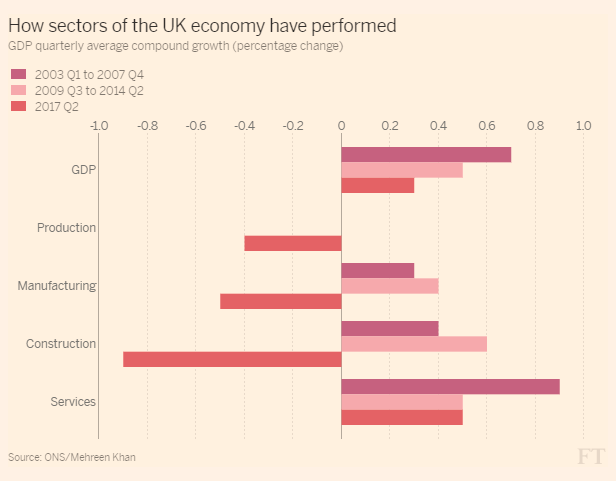

Numbers released by the Office for National Statistics (ONS) yesterday show GDP growth of just 0.3% in the last quarter – most of this coming from consumer spending on goods and services.

With household incomes stagnant for the past three years, the source of this spending has increasingly come from credit cards, bank loans and overdrafts.

Price Waterhouse Cooper estimates this total unsecured debt stands at a historic £270bn, or £10,000 per household. And it continues growing.

Economic growth in the UK then is becoming reliant on ballooning levels of personal debt – and this might be setting us up for an economic crisis.

Lenders of consumer credit are headed towards a “spiral of complacency”, Alex Brazier, the Bank of England’s director of financial stability warned on Monday.

If this ‘spiral’ continued “lending standards can go from responsible to reckless very quickly. The sorry fact is that as lenders think the risks they face are falling, the risks they – and the wider economy – face are actually growing,” Brazier said.

Another warning over the level of personal debt came Labour MP Rachel Reeves, who said on Tuesday:

“Some of those issues we saw in the mortgage market in 2008 are now rearing their heads in unsecured lending and in car purchases”

Reeves, a former HBOS economist, warned that Brits and regulators must remain “vigilant” over increasing levels of personal indebtedness.

Mark Carney Governor of the Bank of England warned in June that the ‘rapid’ increase in consumer credit was posing a particular risk to economic stability.

An ‘overall risk’ is presented by ‘a high proportion of heavily indebted households’, the head of the Bank said; comments that were reiterated by Brazier earlier this week.

Consumer groups have blown the whistle on the historic level of household debt in recent weeks.

“Any increase in borrowing costs could tip households, many of which are already on a financial knife-edge, into serious financial hardship”

Mike O’Connor, the chief executive of StepChange Debt Charity, told the Guardian.

The chief executive of the Money Advice Trust, Joanna Elson, said there had been an 8 per cent rise in the number of people calling its debt helpline this year.

TUC General Secretary Frances O’Grady added her voice to growing concerns, commenting on the ONS figures:

“The government is relying on consumers for what little growth we’re getting. But the signs of strain are starting to show, with real wages falling and families getting deeper into debt.

O’Grady called for the government to increase investment and end the public sector pay cap to boost the economy.

“With businesses reluctant to invest, it’s clear the government needs to step up to the plate with a plan to boost investment, and to get wages rising again.”

“They should start by ending public sector pay restrictions and putting the minimum wage up to £10 as soon as possible.”

Oscar Webb is a reporter for Left Foot Forward. He tweets here.

Left Foot Forward doesn't have the backing of big business or billionaires. We rely on the kind and generous support of ordinary people like you.

You can support hard-hitting journalism that holds the right to account, provides a forum for debate among progressives, and covers the stories the rest of the media ignore. Donate today.

One Response to “Economic growth reliant on household debt – is this the next crisis?”

Mike Stallard

Yup. Lots of debt. And this is partly caused by very high taxation to pay for the Welfare State which pretends to care and to provide for the vulnerable. And to make life better.

It doesn’t.

Yup, national debt spiralling out of control too. This depresses investment (you don’t get any interest if you take a risk and loan money) and also keeps the rates of borrowing very low so that the government can pay back the money it owes without too much interest.

We desperately need – now – to cut back the state, the taxes and to cut the national debt.

As yet there are no signs of doing so. and until that happens people will get poorer and poorer.

I think I shall become a loan shark…;0)