Next month’s budget needs to change a broken system.

Prem Sikka is an Emeritus Professor of Accounting and a Labour member of the House of Lords.

This week a report by the Financial Conduct Authority stated that out of the UK population of around 68 million, 27.7 million adults are experiencing vulnerability to poor health, low financial resilience or recent negative life events. That is an increase of 15% since February 2020, when 24 million were considered to be vulnerable.

Even in the pre-Covid era, large parts of UK population were struggling to make ends meet as the state sponsored austerity and wage freezes deepened the social crisis. In 2019, some 14.5 million people, including 8.1 million people in working families, were living in poverty. Some 4.5 million children live in poverty. This is an increase of 200,000 compared to 2018/19, and the total number was expected to rise to 5.2 million by 2022.

This above state of affairs is the outcome of callous policies implemented by the state. Taxation should be used to eliminate poverty by redistributing income and wealth, but has actually exacerbated inequalities. The Equality Trust has estimated that the poorest 10% of households paid on average 42% of their income in direct and indirect taxes, compared to 34.3% by the richest 10% of the households. The visible hand of regressive taxation is all around us. Here are a few examples.

Since 1993, the minimum recommended standard rate of Value Added Tax (VAT) by the European Union has been 15%. Member states could, however, charge more. The UK did exactly that. From March 1991 to November 2008, the standard rate of VAT was set at 17.5%. After the 2007-08 banking crash, it was reduced to 15% for the period December 2008 to December 2009, and then raised to 17.5% from January 2010 to January 2011. The incoming Conservative administration raised it to 20% from January 2011 though it retained the traditional exemptions on items such as food and children’s clothing. Thus, millionaires and paupers pay the same rate regardless of their income and wealth. This inevitably hit the poorest the hardest and more of their income disappeared in taxes.

The 2011 hike in the VAT rate was accompanied by a move to shift taxes away from capital and the rich. In 2011 the rate of corporation tax was reduced to 26%, culminating in the present rate of 19%. A marginal income tax rate of 50% on annual incomes above £150,000 was introduced from April 2010, but in 2013 the Tory government replaced the 50% band with 45%. Such a move benefitted very few.

Of the 54 million adults, 31 million paid income tax, i.e. 23 million or 43% of adults do not pay income tax as survive on annual income of less than £12,500, which is far less than the national minimum wage. The poor, however, still make National Insurance Contributions (NIC), another regressive tax. Currently, employees generally pay 12% NIC on incomes between £6,240 and £50,000 a year. The NIC rate on incomes above £50,000 is 2%. Inevitably, the rich pay a lower proportion of their total income in NIC compared to the poor,

The council tax is based on outdated property values and bears little relationship to the market value of the property or the ability of the individual to pay. A property worth £3 million or £350,000 pays virtually the same council tax. Consequently, the poorest tenth of the population pay 8% of their income in council tax, while the next 50% pay 4-5% and the richest 40% paying 2-3%.

The top 1% of adults receive around 14% of national income and they are also showered with a variety of tax concessions. For example, only the rich can generate substantial amount of capital gains through ownership of second homes, art works, shares and corporate bonds. Capital gains are taxed at rates varying from 10% to 28% compared to earned income which is taxed at marginal rates varying from 20% to 45%.

The government provides around £40bn a year tax relief on pension contributions to approved pension schemes. Most of it goes to individuals paying income tax at the rate of 40% and 45%. 10% of taxpayers, high earners, received 50% of the relief. Others received little. Some 1.3 million individuals, the poorest, with earnings below the tax-free personal allowance receive no tax relief on their contributions to pension schemes. The government could top-up their contributions, but it does not do that.

The above are just few examples of how a regressive system of taxation has been institutionalised. Rather than relieving poverty, it has widened inequalities and the poor pay a higher proportion of their income in taxes.

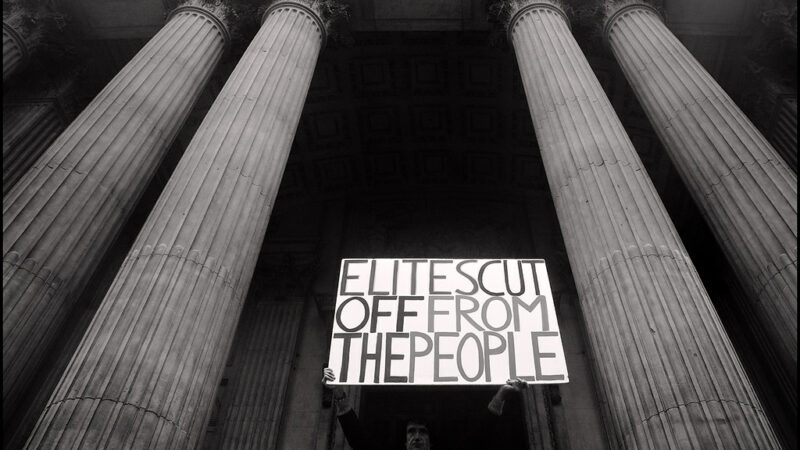

The government is trying to distract attention away from its economic mismanagement by using the slogan “levelling-up”. Any move to reduce inequalities and “levelling-up” would require the government to abandon regressive taxation policies.

Next month’s budget can make a start by abandoning or drastically reducing the rate of VAT and recover the taxes lost by increasing direct taxes upon the rich and corporations. However, a government indebted to wealthy individual and corporate donors is unlikely to listen to the cry of the poor.

To reach hundreds of thousands of new readers we need to grow our donor base substantially.

That's why in 2024, we are seeking to generate 150 additional regular donors to support Left Foot Forward's work.

We still need another 117 people to donate to hit the target. You can help. Donate today.