1.6 million fewer people aged 24-44 bought a home compared to a generation ago -- and 1.8 million more of us are renting privately.

The explosive growth of private rental properties (and extortionate rents) is preventing millions of people from saving for their own home, trapping them in an exploitative and endless cycle with landlords, a new report finds today.

The key findings of the report from Localis show that:

- The number of homes bought by people aged 24 to 44 with a mortgage has dropped by over 1.6 million in just over a decade.

- 58 percent of people who do not already own their home (outright or with a mortgage) are saving nothing at all each month for a deposit to buy a home in the future.

- The number of people aged 24-44 renting privately has increased by close to 1.8m in the past decade.

Why does this matter? Put simply, paying a mortgage is typically far cheaper than paying rent:

Households that rent typically spend twice as much of their income (35 per cent) on rent as owner occupiers do on mortgage payments (17 percent).

Add to this the fact that the quality of private rented homes tend to be worse than those of owner-occupied homes, and the argument for home ownership vs. private renting becomes stronger.

For example, in 2015/16, 28 per cent of homes in the private rental sector failed to meet the government’s Decent Homes Standard compared to eighteen percent of owner-occupied homes.

Of those the report surveyed (people who do not currently own a home), only 23 per cent were saving anything for a deposit.

Last year, the average deposit for a first time buyer in the UK was £32,321 and in London it was £100,445.

The average young family has to save for 19 years to accumulate enough for a typical deposit; a generation ago, it took on average just 3 years, the Resolution Foundation found recently.

The report argues that Britain as a ‘home-owning democracy’ — a phrase popularised by Margaret Thatcher — is under threat.

Owning a home, Liam Booth-Smith, Chief Executive at Localis says, is a “bulwark against populism and radicalisation: when you have a tangible stake in society you are less likely to want tear it down.” Jack Airey, Head of Research at Localis said:

“Whether out of choice, or simply because they do not have enough money at the end of each month to do so, a majority of people are not building any financial capacity with which to get a mortgage and purchase a home in the future.”

“This crisis of saving transcends people of all tenures, ages, regions and socio-economic classes yet these consequences are underappreciated, least of all by non-homeowners themselves”, added Airey.

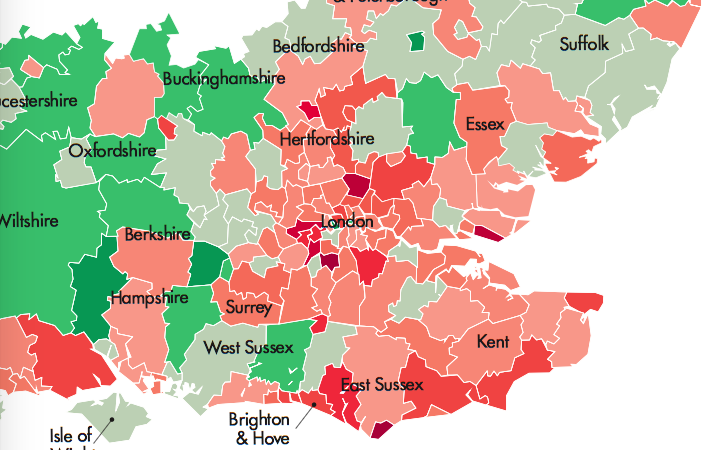

Solving the housing crisis will require more than just helping people save for deposits: we need rent controls in extortionate areas like London, actions against exploitative buy-to-let landlords and a proper house building programme to boost social and non-social housing stock.

To reach hundreds of thousands of new readers and to make the biggest impact we can in the next general election, we need to grow our donor base substantially.

That's why in 2024, we are seeking to generate 150 additional regular donors to support Left Foot Forward's work.

We still need another 124 people to donate to hit the target. You can help. Donate today.